Delphian provides multiple, earnings specific data sets for each of the close to 4,500 companies tracked in the platform. Data sets include EPS surprises, past earnings day moves, pre-earnings day moves, post earnings day moves, seasonality, volatility rise and volatility crush analysis.

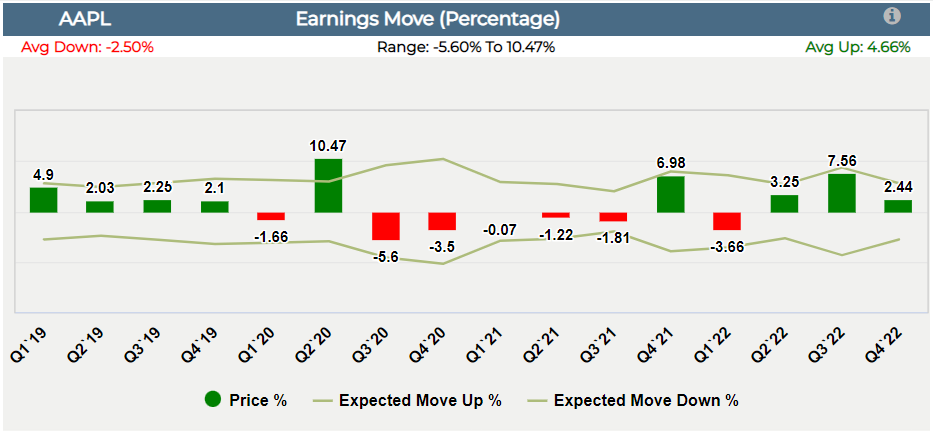

Does a company's earnings report consistently produce large moves in the stock or does it usually stay within the expected move? Delphian provides a historical analysis for all companies. Seasonal analysis by quarter is also available.

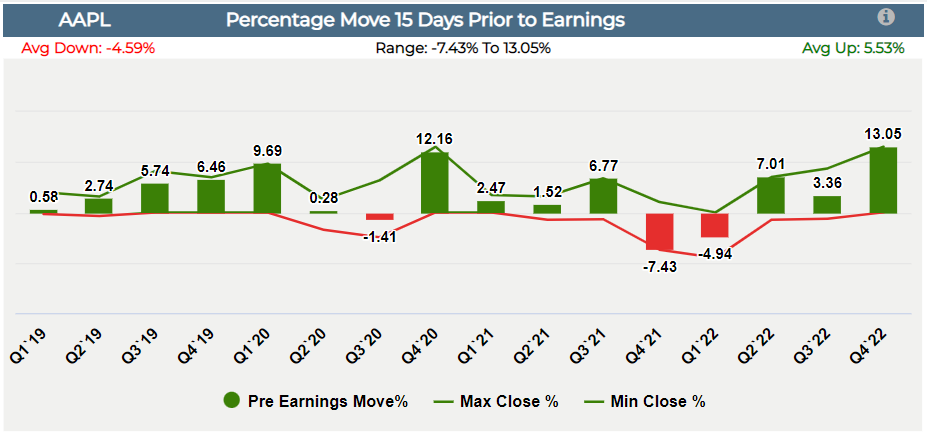

During the lead up to the earnings announcement, some companies have prices the consistently run higher and some have consistent runs lower. Delphian provides the tools to screen for companies that consistently perform these moves.

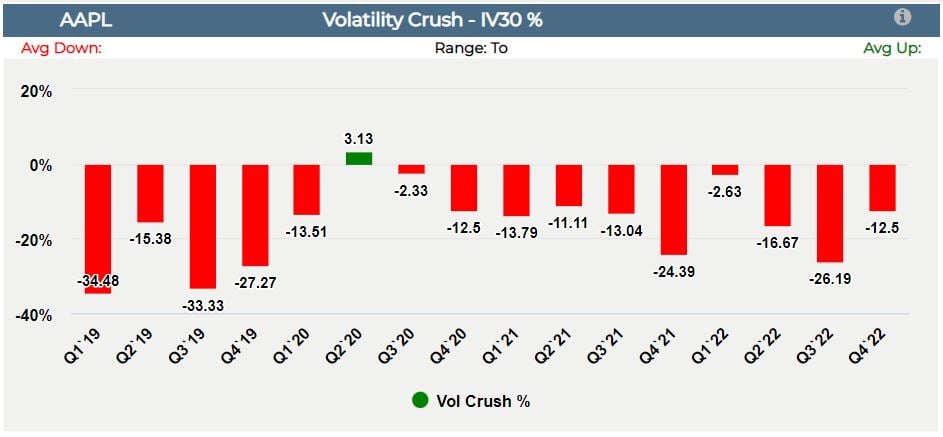

Delphian makes it easy to find companies that regularly have a large volatility crush after earnings.

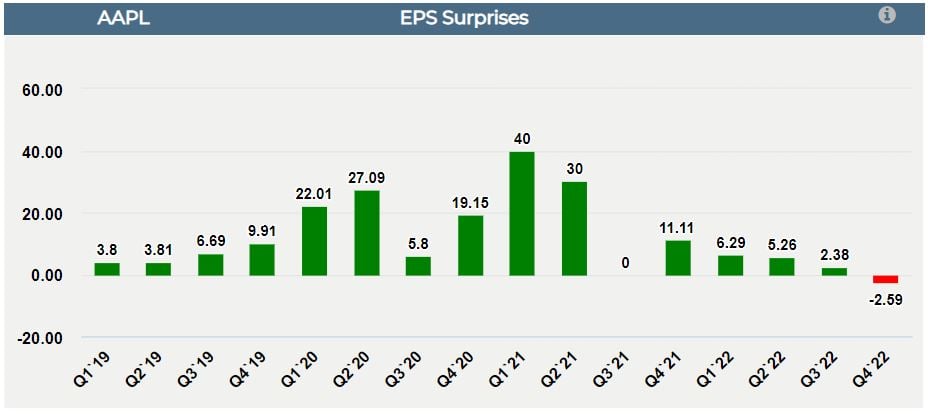

Has a company historically beat EPS expectations? Delphian provides the answers including the beat percentage.